santa clara property tax rate 2021

Please visit our State of Emergency Tax Relief page for additional information. Santa Clara Valley Water District North Central Zone.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Unsure Of The Value Of Your Property.

. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. In-depth Santa Clara County CA Property Tax Information. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

Santa Clara County collects on average 067 of a propertys. Ultimate Santa Clara Real Property Tax Guide for 2021. The bills will be available online to be viewedpaid on the same day.

Close SCCGOV Menu. Ad Find County Online Property Taxes Info From 2022. The 9125 sales tax rate in Santa Clara consists of 6 California state sales tax 025 Santa Clara County sales tax and 2875.

In santa clara county it is customary for sellers to pay for the county tax 110 per 1000. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. The bills will be available online to be viewedpaid on the.

This is the total of state county. Find All The Record Information You Need Here. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

The minimum combined 2022 sales tax rate for Santa Clara California is. Notice that we used 2021-2022 tax rates since. The California sales tax rate is currently.

Skip to main content How do I. Notice that we used 2021-2022 tax rates since. This is the total of state county and city sales tax rates.

Town Of Santa Clara. Santa Clara County has one of the highest median property taxes in the United States. This report shows the allocation of property tax in Santa Clara County for your tax rate area.

In-depth Santa Clara County CA Property Tax Information. Ultimate Town Of Santa Clara Real Property Tax Guide for 2021. Santa Clara County collects on average 067 of.

For a comprehensive tax rundown like the sample below create a free account. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. What is the sales tax rate in Santa Clara California.

As of June 18 2021 the internet website of the California Department. 0375 lower than the maximum sales tax in CA. The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021.

For a comprehensive tax rundown like the sample below create a free account. Property Tax Distribution percentages for the County of Santa Clara.

The Average Property Tax Rates In California

Home Lennar Resource Center Home Ownership New Homes For Sale Home Buying

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax California H R Block

Secured Property Taxes Treasurer Tax Collector

Why Buy Now Lennar House Styles New Homes

The Former Kmart At Monaco And Evans In Denver Has Sold After Sitting Vacant For Nearly 7 Years Https Dpo St 2 Multifamily Housing Vacant Colorado Adventures

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

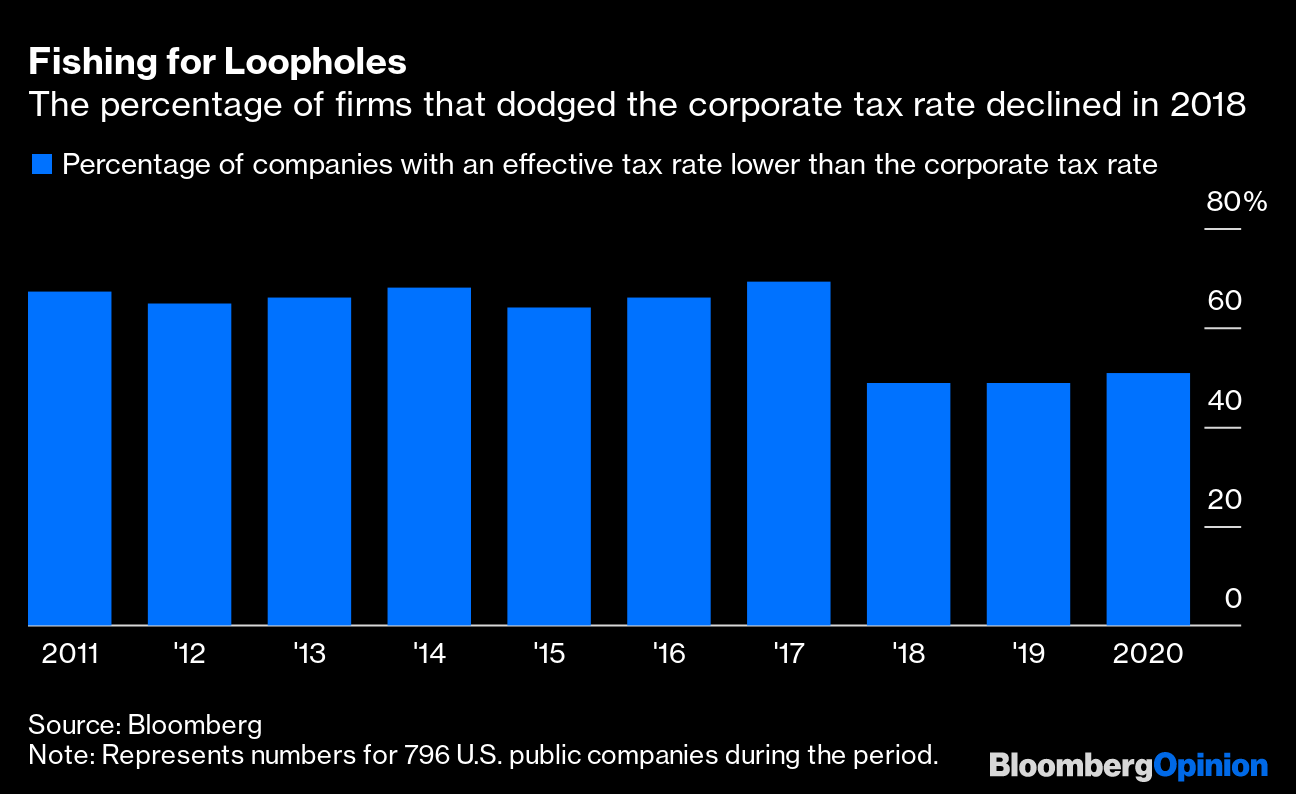

Corporate Tax Loopholes Matter More Than A Higher Rate Bloomberg

Secured Property Taxes Treasurer Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Gross Receipts Location Code And Tax Rate Map Governments

How To Calculate Property Tax And How To Estimate Property Taxes